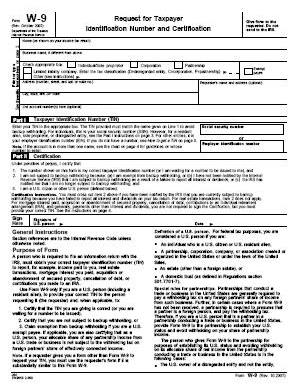

Why Use A W9 FormIf you are doing some business with a person who is an independant contractor, and paying him directly without a W4 form (Employees Withholding Allowance Certificate) being involved, or withholding the required amount of money for the IRS, then you must ask him or her for a W9 form to be filled out. The law requires...That any person who gets an amount paid to them as a sole proprietor, etc, for over $600.00 is due to get a 1099 form for tax filing purposes. The W-9 form is essentially a Request for Taxpayer Identification Number and Certification". As an example: The W9 form is requested when a person pays out money to someone who did or will be doing landscaping work, etc on the payers property for the year. It requires earning more than $600.00. It also applies to a person who earns more than $600.00 in interest, etc.

FinesYou have to sign it and date it. You can be charged with perjury and fined up to $500.00 if you put false information on the form. If you are earning money "Under the table" as they say then you really should be filling out the W9 and submitting it to your payer.

At the end of the year you should receive a form 1099 from your payer with the amount paid to you. Use this 1099 when filing the tax on your income. The form also asks for your form of ID. It would be your Social Security number or your Employer ID number. For refusal to submit a W9 form that is lawfully requested you can be fined up to $50.00 for each occurance. Your IRS wants information about your taxable income.That is for things that are not covered on a W-2 form, such as interest, money paid for work as an individual or sole proprietor, money from real-estate transactions, cancellation of debt, money contributed to an IRS etc. The W9 form has four pages. The first page is the form itself and the other pages are instructions. If you are not a resident of the USA then use the IRS Form W-8 Instructions and W8-BEN The Form 1099Must be sent by the end of January in most years. A failure to send a proper 1099 form can be fined at $50.00, and if you fail to send it on purpose the fine can be $100.00 for each time. |

For good tax information and printable forms, we also recommend www.TaxMan123.com.

For good W9 information we suggest www.PrintW9.com.